With the new deadline to settle most U.S. and Canadian securities in one day looming at the end of May, the market is focused on what will happen when some firms inevitably do not meet it.

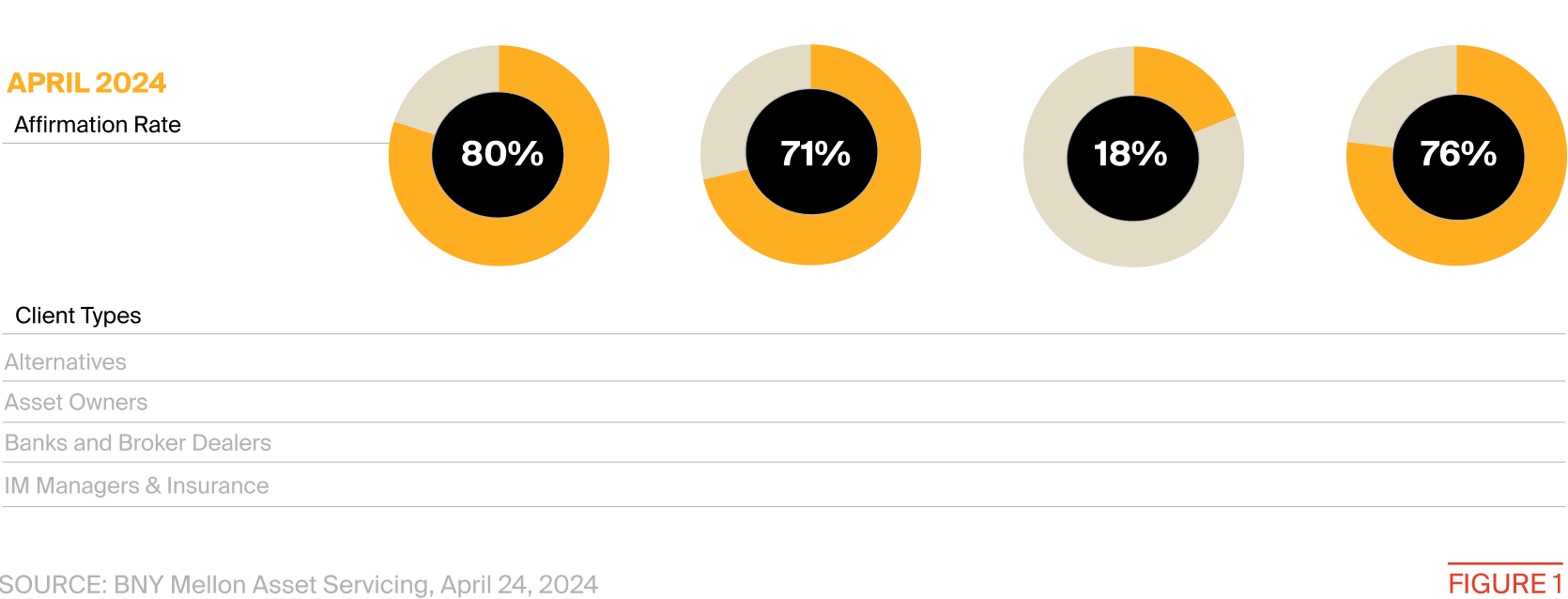

Industry data show that many across Europe and the U.S. made adherence something of a New Year’s resolution1, but that several institutions in Asia are lagging far behind (see Figure 1), an issue complicated by time zone differences that give them a full day less to meet the requirements.

Scottish fund manager Baillie Gifford & Co., which oversees $270 billion in assets, told Aerial View it has already moved two traders to New York from Edinburgh in preparation. Concerns about systemic risk amid the potential for rising settlement fails have prompted the firm to check in withcounterparties about their own progress in meeting the new T+1 deadlines, according to Adam Conn, Baillie’s head of trading.

The current rate of transaction instructions being affirmed on trade date raises questions about the readiness of asset owners with international portfolios. For those in Asia, one-day settlement (T+1) may as well be same-day settlement (T+0).

We are asking central banks if they’re willing to break glass [and step in]. Otherwise, if firms can’t settle on time, who is going to pick up the slack?

Some financial experts predict that the laggards may face costly repercussions as inflows are temporarily mismatched against outgoings, which could impact trading across the wider market.2

A bigger risk, Conn says, may be an insufficient availability of U.S. dollars in times of stress, especially for investors outside of the U.S., if there is a spike in trade fails and counterparties need to borrow funds at short notice. Banks, broker-dealers and custodians have normally handled such shortfalls, but a jump in fails may require additional sources of funding,3 an issue that Conn says financial trade associations have raised with central banks.

“With our trade associations, we are asking central banks if they’re willing to break glass [and step in],” he says. “Otherwise, if firms can’t settle on time, who is going to pick up the slack?”

Two Steps Forward

Mismatches are also a worry for market infrastructure providers at the end of the chain. The more bottlenecking, the greater likelihood that those intermediaries will not have the instructions that they need to settle on behalf of clients at the right time.4

Most participants appear likely to overcome the significant operational and procedural challenges, and there are various solutions available that will allow them to enjoy the fruits of a shortened settlement cycle. Some will not, or not right away.

That could shine a spotlight on pain points and give the industry and regulators a better handle on when, or how, it might become possible to move to T+0 settlement at some point in the future.

APAC’s Readiness Lags

The continued use of paper despite the availability of more modern tools has been identified as a big part of the problem in driving greater efficiency. Unstructured data, such as in faxes, emails, PDFs and data scraped from screens, are inhibiting workflows and preventing some firms from being T+1 ready, a recent Coalition Greenwich study found.5 Audrey Costabile, a senior analyst at the research firm, said a key factor in financial firms’ tardiness is the basic issue of corporate- budget priorities tending to favor mandatory regulatory activities and, where possible, revenue-generating functions over efficiency enhancements in the middle and back office.

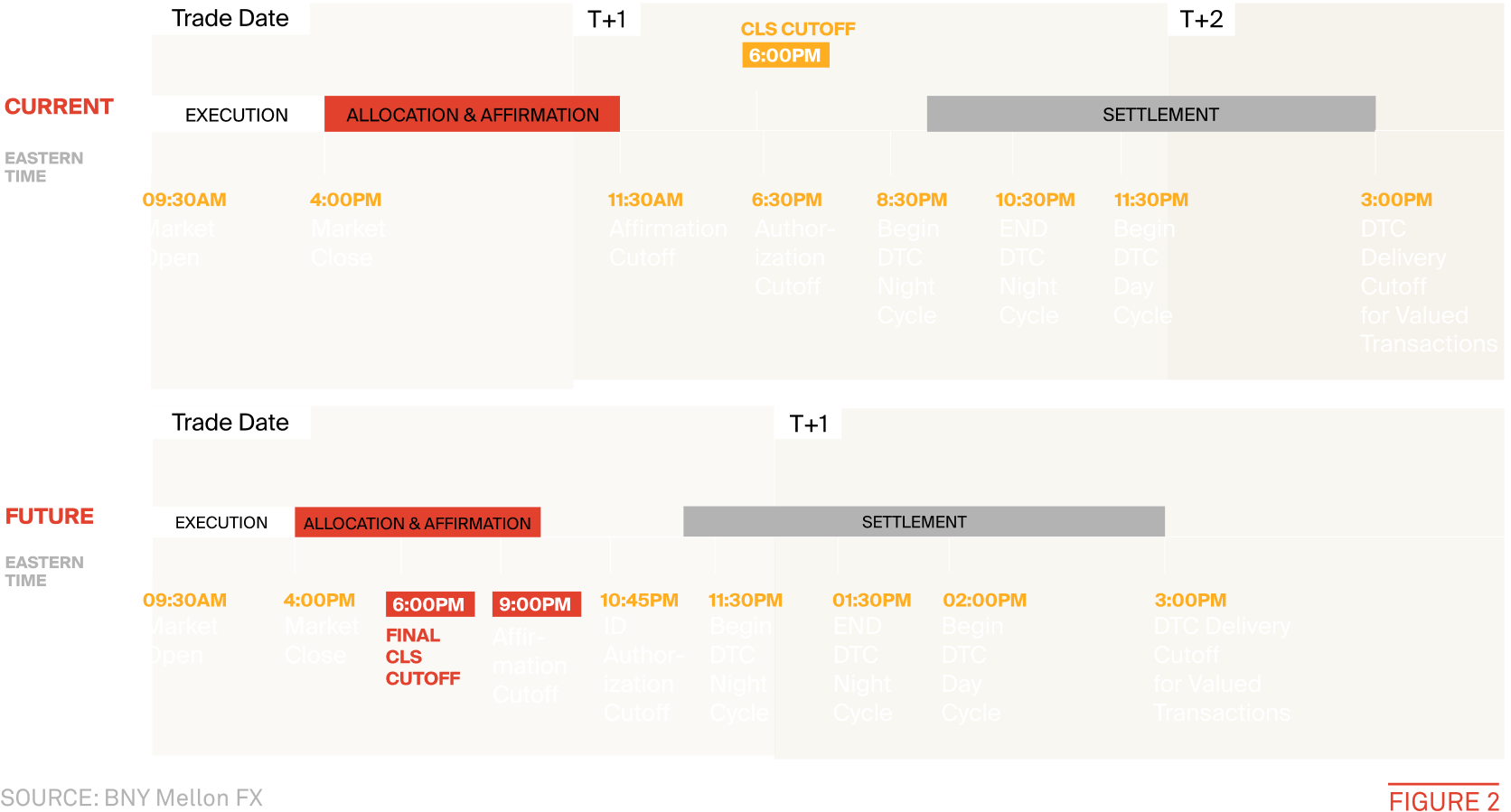

“Things like [communications] surveillance and innovative technologies, including generative AI, are attracting a lot of money,” she said. “Firms are looking at which fires they want to put out and what they think will generate return-on-investment before the back office.” The requirement of the rule is to affirm trades that ultimately hit the Depository Trust & Clearing Corp. (DTCC)’s night cycle by midnight on the day of trading, but the industry has set a 9 p.m. Eastern U.S. deadline for this to happen. Some view the firms who can submit affirmations by then as generally more likely to achieve final settlement on time for T+1.6

The new settlement deadline means firms will have much less time to send allocations, confirmations and affirmations for “block” trades to intermediaries like executing brokers, according to Bob Walley, principal at Deloitte Advisory. “Today, industry participants have 19 hours, and after May 28 they’ll have five,” he says.

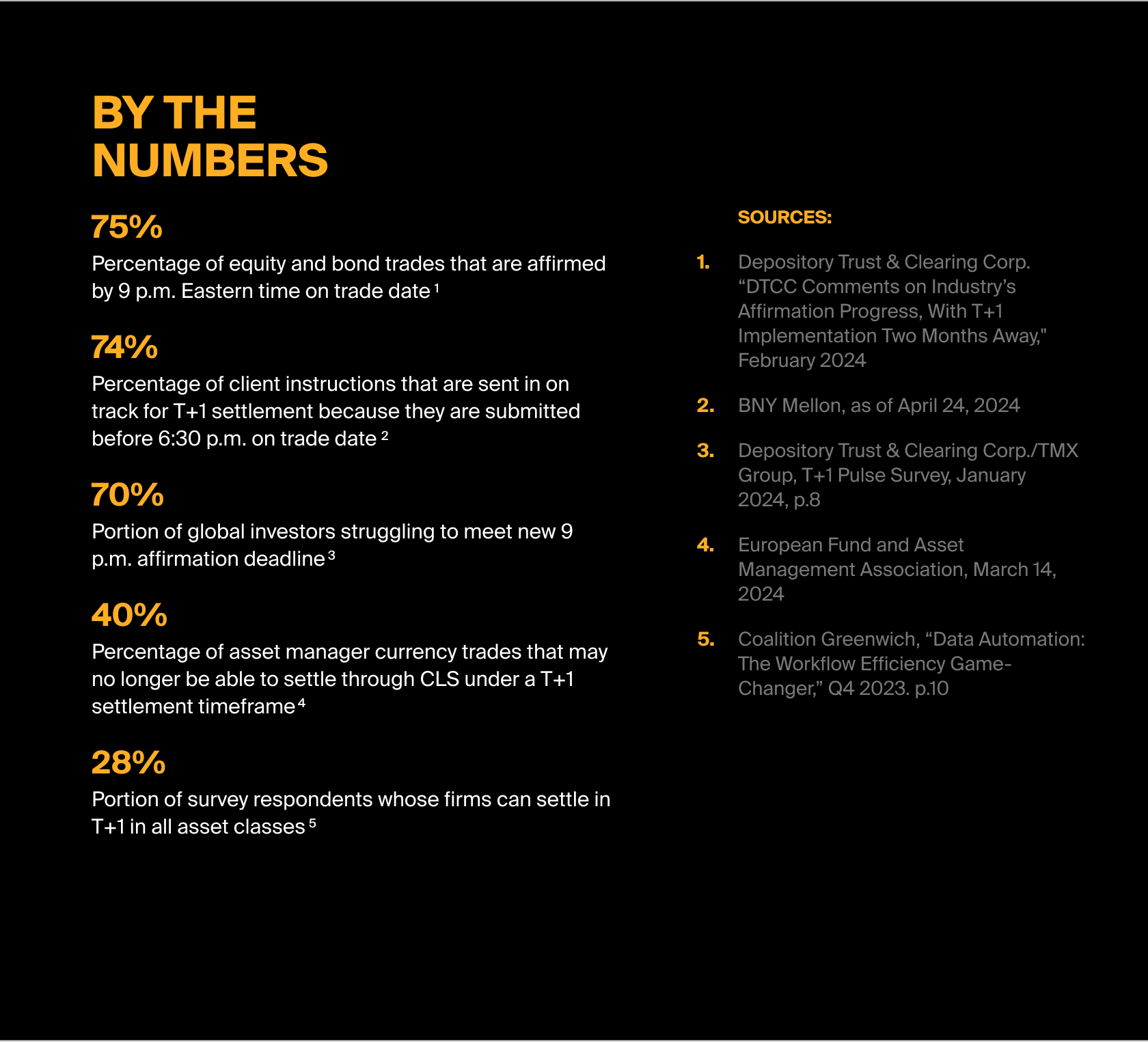

Roughly 75% of equity and bond trades are affirmed before a 9 p.m. EST nighttime settlement cycle operated by the Depository Trust Co. (DTC), according to the central securities depository. If clients do not make that, they can settle in DTC's daytime cycle, but they may need to take additional steps to do so, making the process less operationally efficient. The daytime cycle also costs more, so Val Wotton, general manager of the depository's institutional trade processing, said that broker-dealers, custodians and other service providers will likely encourage clients to affirm their trades in time for the 9 p.m. (see figure 2) cutoff so that they do not have to pay higher costs.

As of late April, some 74% of in-scope equity and bond trade instructions were being submitted by 6:30 p.m. on trade date, up from 70% in November, according to BNY Mellon data, with another 22% coming in on the second day and around 4% submitted after the second day. Only 8% of client instructions from APAC come in on trade date, and the issues are more pronounced with banks and broker-dealers, where only 3% are coming in before 6:30 p.m., the bank’s data show.

These mismatched timeframes have put T+1 settlement on other regulators’ radar screens. The U.K. Accelerated Settlement Task Force (ASTF) wants to move to T+1 no later than 2027 and potentially align the U.K. and European Union (EU) transition periods.7 Meanwhile, the European Securities and Markets Authority (ESMA) plans to release a report in the second half of 2024 with its assessment of the feasibility of a shortened settlement cycle.8 Australia plans to publish its own report and next steps in August.9

T+1: What to Consider

As the T+1 settlement transition in the U.S., Canada and Mexico quickly approaches, investment managers face the biggest hurdles, while broker-dealers, custodians and other service providers are figuring out how best to help them. Here are some of the key issues to consider:

- Whether and how to automate your settlement processes.

- FX settlement implications for managers based in APAC and EMEA.

- Whether to address issues in-house or with the help of vendor.

- How to increase oversight of in-house and third-party managers.

- Whether securities lending recalls may result in an increased risk of fails.

- Whether overdrawn funds will result from settlement cycle discrepancies.

- How to handle CLS’s FX settlement no longer being available to many investors.

- Whether extra staff and resources are needed to handle post-transition complication.

- Whether predictive analytics are necessary to smooth future T+1 hiccups.

- Whether other regions are moving their settlement cycle transitions.

Funding and Liquidity

Besides the clear operational hurdles, there are also foreign exchange and liquidity issues that go along with operating many international portfolios. An asset manager using the proceeds of a U.K. securities sale to buy securities in the U.S. will face a conundrum, for example, because the U.K. trade tends to settle a day later and may not bring in the required capital to fund the purchase.10

Today’s higher rates do not help. Market participants in such scenarios may have to borrow funds from overnight lenders, potentially paying more than 5% for the cash on overdraft based on current interest rate on reserve balance levels.11

We probably won’t see prefunding in major markets because that puts a lot of pressure on investors who would have to come up with cash in advance.

India plans to move to limited same-day settlement by the end of this year, and market participants there will be required to prefund their accounts before trading,12 an approach that virtually guarantees settlement. But that idea is unlikely to be rolled out in all markets.

“We probably won’t see prefunding in major markets because that puts a lot of pressure on investors who would have to come up with cash in advance,” says RJ Rondini, director of securities operations at the Investment Company Institute (ICI).

India’s time zone difference resulted in a liquidity squeeze early in the day, and the U.S. market could see the same happen toward market close, even if T+1 settlement ultimately bolsters market liquidity as participants free up capital sooner.

Liquidity is an especially important consideration for the foreign exchange leg of a bond or equity transaction. Exchanging pound sterling into U.S. dollars can be instantaneous on screen, but it can take up to two days for standard spot trades to settle along market conventions.13 Funding the purchase of securities in the U.S. after the market close in New York could put an added strain on those firms that are already finding it difficult to source U.S. dollar liquidity at certain times of day.

One issue potentially affecting hedge funds and smaller asset managers outside of the U.S. is what to do about Friday trades that may have to be affirmed before the weekend. Large, multinational asset managers can assign staff in different time zones to address trade complications that arise during the trading day, but smaller firms may have to ask staff to monitor for settlements snafus on Saturday mornings or remain on call through the weekend.

Even firms in North America may have to adjust employee hours or locations to ensure timely affirmations, or, if possible, shift some tasks to the West Coast to capture extra hours in the workday.

Outsourced trading solutions are available globally from custodians that will enable asset managers to execute securities and corresponding FX transactions in essentially real time, using standing client instructions, and some custodians are opening up those capabilities to non-custody clients.

Technology company AccessFintech has built systems that can predict14 which equity and bond trades are most likely to settle within T+1, and clients in their network can now instruct BNY Mellon to execute only those FX transactions before the end of the U.S. trading day on the client’s behalf.

FX and Securities Timeline

Old Habits Die Hard

Not all frictions will be easily overcome. CLS, the third-party FX settlement service, announced in April it would not be moving its deadline (midnight Central European Time, which is 6 p.m. Eastern Time), by when all initial payments are calculated on eligible FX trades, in part because many members said accommodating such a change would involve onerous system development.

BNY Mellon is adding an extra hour for clients to get their CLS-eligible trade instructions to the bank to increase the chances of those trades making the CLS deadline. Separately, the bank is allowing extra time for FX trade instructions it is executing on behalf of clients to come in for same-day set tlement, on trades denominated in the Australian dollar, New Zealand dollar, Hong Kong dollar, Singapore dollar and Japanese yen.

Investment managers also are exploring a number of options outside of CLS, including bilateral settlement, prefunding parts of their obligations, moving staff to the U.S., extending their hours and leveraging custodians’ automated solutions.

These workarounds could be challenging. A survey by the European Fund and Asset Management Association (EFAMA) found that up to 40% of asset managers’ currency trades, representing between $50 billion and $70 billion daily, would no longer be able to settle through the CLS platform, which could result in bilateral settlement that might increase risk and runs, contrary to regulators' push for more central clearing of transactions.15 Standing instructions given to executing brokers could speed up the process and alleviate some concerns, but the T+1 rule may test index fund managers if new reporting cutoff times are unattainable.

The first few weeks will see increased friction until market participants adjust to the new normal.

Ultimately, real-time data across the board may be required to achieve same-day settlement. In addition, firms must improve their ability to predict and thwart potential settlement failures, probably using technologies such as artificial intelligence. At the macro level, they must also be able to identify and correct pockets of inefficiencies.

Christos Ekonomidis, T+1 program director at BNY Mellon, said clients need to anticipate liquidity issues and higher overall trading costs in the short term. “The first few weeks will see increased friction until market participants adjust to the new normal,” he says.

While the rule levies no penalties for missing affirmation or settlement deadlines, the cost of missed deadlines adds up on its own and T+1 fixes may quickly gain budgeting priority. Securities and Exchange Commission examiners may question the broker-dealers and asset managers about their compliance with the rule. The agency said in a risk alert that, “To assess registrant preparedness, [it] intends to continue engaging with registrants through examinations and outreach.”

In the meantime, no matter how self-assured financial-services firms may be about their own preparations, it takes two to trade, and firms should expect the unexpected as the new deadline comes into effect. Even market participants who deem themselves to be T+1-ready should ensure adequate resources are in place to deal with the potential snafus from those who are not.

“We and our counterparties are ready and have tested in advance of the transition, but success will depend on the right people doing the right things at the right time with the right data,” Ekonomidis notes.

John Hintze is a freelance writer for Aerial View, based in New Jersey.